Household Finances

To have a great life, you need a strong household financial foundation .

This involves not just today, but the foundation for your children and their children.

Setting your household foundation

This takes planning.

Over the years, We at Life Choices have learned that invested money doubles every 7 years, roughly when invested in an index fund that mirror the S&P 500 in the United States.

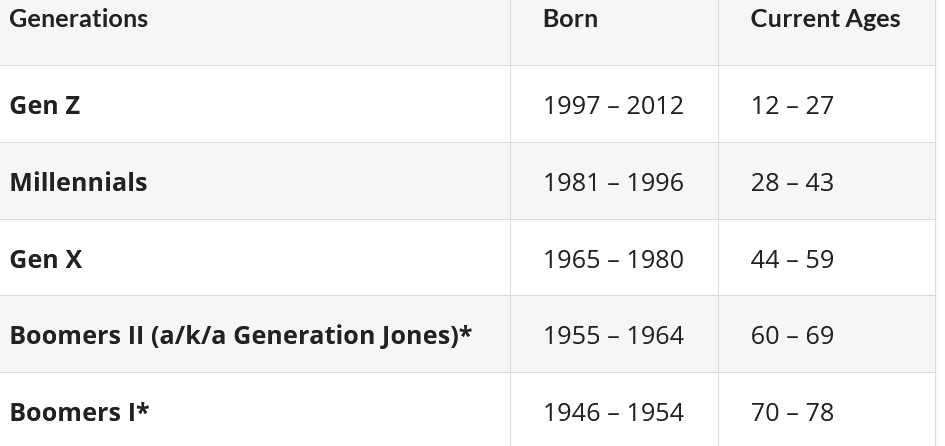

Each Generation has different ideologies. Your why for finances is going to be different. The tax code has also changed.

Instead of worrying about hourly wages, a successful household financial foundation uses wages per year and month.

It does not factor wages per hour in a pay period.